Exercitation ullamco laboris nis aliquip sed conseqrure dolorn repreh deris ptate velit ecepteur duis.

Essential Metrics Every Multifamily Investor Should Understand

-

Vestio Capital > Education > Multifamily Apartments Investing Education > Essential Metrics Every Multifamily Investor Should Understand

Essential Metrics Every Multifamily Investor Should Understand

Essential Metrics Every Multifamily Investor Should Understand

Investing in multifamily properties can be a lucrative venture, offering consistent cash flow and long-term growth. However, to make informed investment decisions and maximize returns, it’s crucial to understand and analyze key metrics. This article highlights the essential metrics every multifamily investor should know and how they impact property evaluation and investment success.

1. Net Operating Income (NOI)

1. Net Operating Income (NOI)

Net Operating Income (NOI) is a fundamental metric in multifamily real estate investing. It represents the property’s total income minus its operating expenses, excluding taxes and financing costs. NOI provides a clear picture of a property’s profitability and is used to calculate other important metrics, such as capitalization rate and cash flow.

2. Capitalization Rate (Cap Rate)

The Capitalization Rate (Cap Rate) is used to estimate the return on investment for a multifamily property. It is calculated by dividing the NOI by the property’s purchase price or current market value. The Cap Rate helps investors compare the potential return on different properties and assess their investment risk.

3. Cash-on-Cash Return

Cash-on-Cash Return measures the annual return on the cash invested in a property. It is particularly useful for evaluating the performance of a property relative to the amount of cash invested, providing insights into the investment’s profitability.

![]()

4. Gross Rental Income

Gross Rental Income is the total income generated from renting out the property before any expenses are deducted. This metric helps investors understand the property’s income-generating potential and serves as a starting point for calculating other financial metrics.

5. Operating Expenses Ratio

The Operating Expenses Ratio provides insight into the proportion of income that is spent on operating expenses. A lower ratio indicates better management and higher profitability. This metric helps investors gauge the efficiency of property management and operational costs.

![]()

6. Vacancy Rate

The Vacancy Rate measures the percentage of rental units that are unoccupied. A high vacancy rate can indicate issues with property management, location, or market conditions. Monitoring this metric helps investors assess the potential for rental income loss and make adjustments to improve occupancy rates.

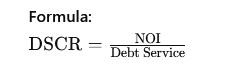

7. Debt Service Coverage Ratio (DSCR)

The Debt Service Coverage Ratio (DSCR) measures a property’s ability to cover its debt obligations with its operating income. A higher DSCR indicates that the property generates sufficient income to cover debt payments, reducing financial risk for investors.

8. Return on Investment (ROI)

Return on Investment (ROI) evaluates the profitability of an investment relative to its cost. It is a broad metric that considers both cash flow and property appreciation, helping investors assess overall performance and compare different investment opportunities.

9. Internal Rate of Return (IRR)

The Internal Rate of Return (IRR) represents the expected annualized rate of return on an investment, factoring in both cash inflows and outflows over time. IRR helps investors evaluate the long-term profitability of a property and compare it to other investment options.

Conclusion

Understanding and analyzing these essential metrics is crucial for multifamily investors to make informed decisions and maximize returns. By focusing on Net Operating Income, Capitalization Rate, Cash-on-Cash Return, and other key metrics, investors can effectively evaluate properties, manage risks, and achieve their investment goals. Regularly monitoring these metrics ensures that your multifamily investments remain profitable and aligned with your overall strategy in Housing developments.